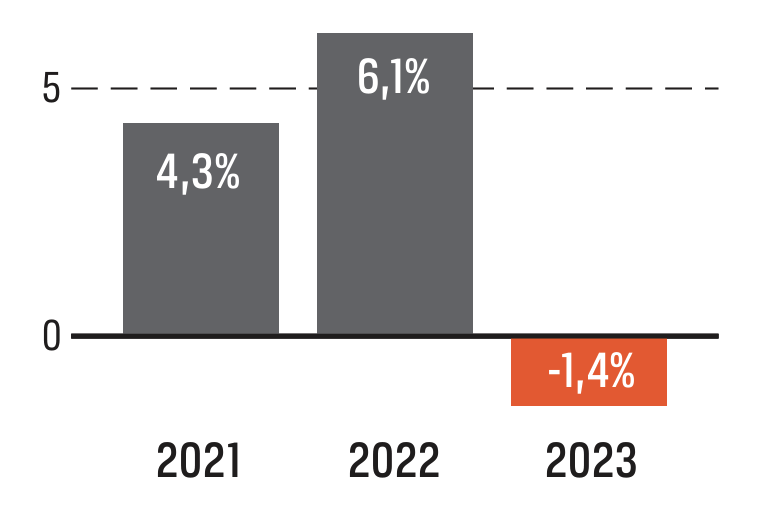

Organic growth

Average organic growth shall be more than 5 per cent per year over a business cycle. Further growth shall also be made through acquisitions.

Alligo’s financial targets focus on profitable growth, financial stability and dividend. The targets have been set based on Alligo’s conditions during a medium-term strategy period. The targets were adopted during the first quarter of 2022.

Average organic growth shall be more than 5 per cent per year over a business cycle. Further growth shall also be made through acquisitions.

The weaker market in 2023 mainly affected Sweden, but also Finland in the second half of the year. Norway performed better due to strong development in the oil and gas segment.

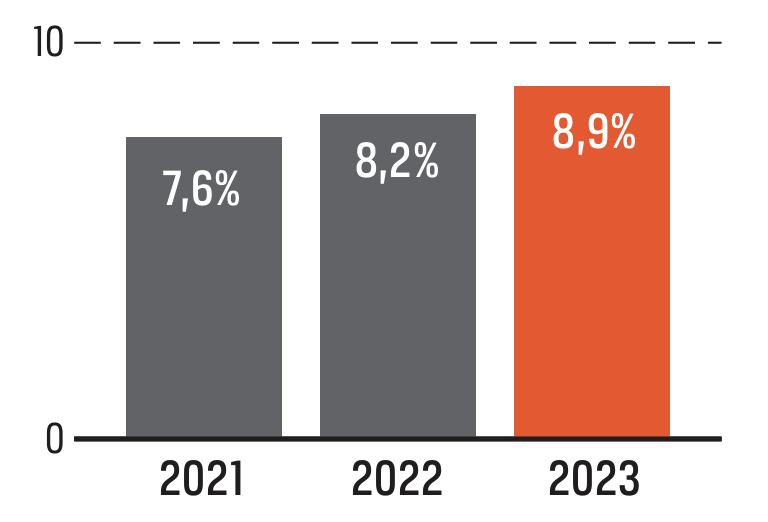

The EBITA margin shall be more than 10 per cent per year.

A higher gross margin and cost adjustments contributed to the improvement in the adjusted EBITA margin. Profitability increased in Norway and remained stable at a high level in Sweden, while it was weaker in Finland due to investments in stores.

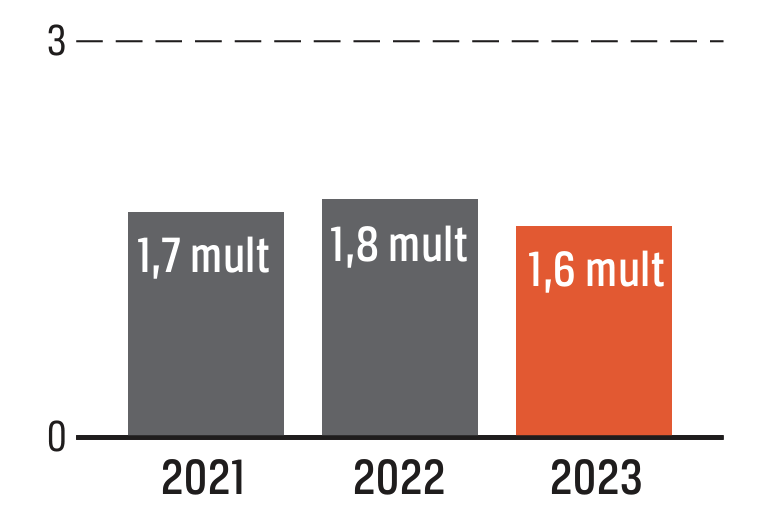

Ratio of net operational liabilities to adjusted EBITDA shall be less than a multiple of 3.

Net liabilities were lower at the end of 2023 compared to 2022 as a result of the improved cash flow and efforts to reduce inventory levels. Higher investment level, completed acquisitions, dividends and repurchase of own shares offset this effect. The strong financial position provides a solid foundation for continued growth and means we are well prepared to take advantage of future acquisition opportunities.

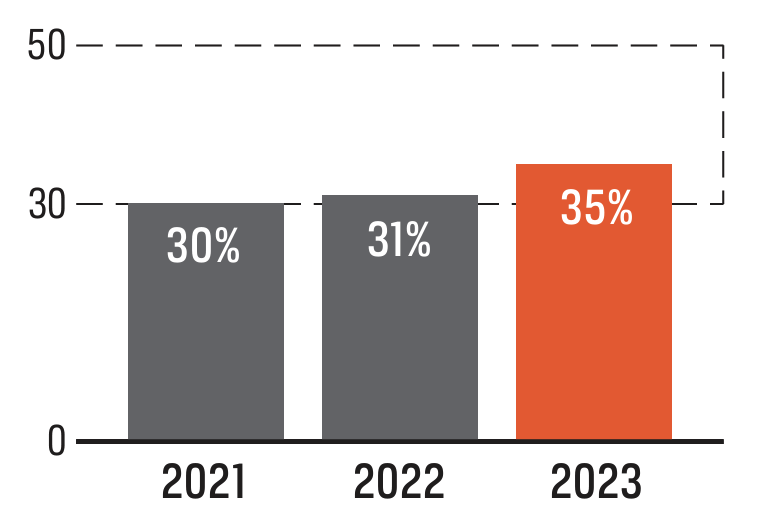

The dividend as a percentage of net profit shall be 30–50 per cent, taking into account other factors such as financial position, cash flow and growth opportunities.

Board of Directors proposes a dividend of SEK 3,50 (3,00) per share, equivalent to 35 per cent of earnings per share for continuing operations and the financial year.